New report shows how much hail, wildfire contribute to Colorado homeowners insurance costs

Austin Colbert/The Aspen Times

Hail, not wildfire, is the largest driver of homeowners insurance costs in Colorado, according to a report released Wednesday by the Colorado Division of Insurance.

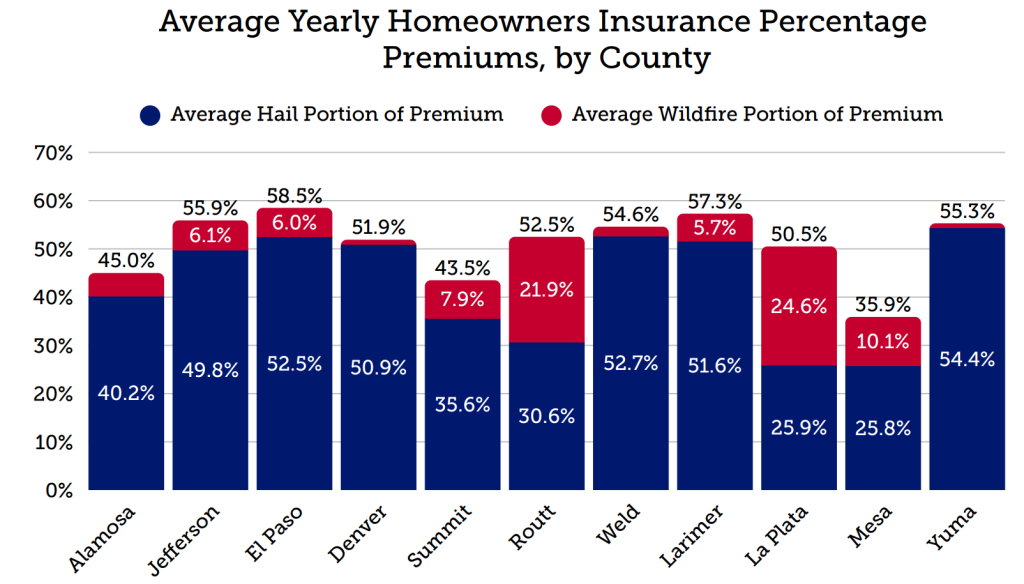

The insurance division requested data from 20 homeowners insurance carriers, representing 80% of the state’s total market, to calculate average premiums in 11 counties.

The division found that hail can account for anywhere from 26% to 54% of a premium’s costs, while wildfire accounts for as little as 0.9% to 24.6%.

Wildfire risk accounted for more of an insurance premium’s cost in high-risk Western Slope areas. Less than 1% of insurance prices in Denver, for example, are due to wildfire, while in La Plata County in southwestern Colorado, nearly a quarter of costs are due to wildfire.

The report also included two mountain counties, Summit and Routt, and found that wildfire contributes to 7.9% and 21.9% of homeowners’ insurance costs in those counties, respectively.

The report analyzed how much of a discount a homeowner could see for completing hail and wildfire mitigation. It found that hail mitigation can save homeowners an average of $82 to $387 per year, compared to $3 to $25 per year for wildfire mitigation.

Savings for wildfire work were greater for Western Slope and mountain communities.

“While wildfire mitigation will continue to be key for safety and for availability of insurance coverage, the lack of available discounts for wildfire mitigation work shows that other solutions, like increased authority to mandate discounts or reinsurance solutions, must be considered to address affordability concerns caused by wildfire risk,” the report states.

Support Local Journalism

Support Local Journalism

The Sky-Hi News strives to deliver powerful stories that spark emotion and focus on the place we live.

Over the past year, contributions from readers like you helped to fund some of our most important reporting, including coverage of the East Troublesome Fire.

If you value local journalism, consider making a contribution to our newsroom in support of the work we do.